When we speak with physicians across Canada, we often hear the same complaints. Whether they’re a GP or a specialist, one thing is for certain – they hate billing. The most common billing challenges for physicians that we hear are:

Too much paperwork

Billing and admin tasks involve mountains of paperwork. Not only is this cumbersome, but it makes it hard to keep track of patient and claims.

A study by the Canadian Medical Association showed that the average physician fails to bill for at least 5% of the insured services they provide.

Claim complexity

Medical billing is complicated. There are so many codes, premiums and special circumstances to remember … it’s enough to give you a headache.

Here’s an example from the MSC Payment Schedule for BC physicians:

” 2. Consultations

a) 01015 applies when a certified specialist anesthesiologist is requested to assess a

patient because of the complexity, obscurity and/or seriousness of the case. It may or may not be associated with a subsequent anesthetic. If this consultation is followed by an anesthetic within 24 hours by the same consultant, a pre-anesthetic assessment will not be paid in addition. If the anesthetic is given by the same consultant after an interval of more than 24 hours, or a different anesthesiologist within 24 hours, then the appropriate pre-anesthetic evaluation will apply.

b) 01115 applies to two situations:

i) When a repeat consultation is done for the same condition within six months by the same consultant. If it is done by the same consultant for a different condition, or a different consultant for the same condition within six months, 01015 will be paid if the problem is appropriately complex, obscure and/or serious.

ii) 01115 also applies for a limited consultation when in the opinion of the consultant the problem does not warrant 01015. If a repeat or limited consultation is followed by an anesthetic within 24 hours by the same consultant, a pre-anesthetic assessment will not be paid …”

It goes on, but you get the point. This complexity can lead to routine errors – mistakes that will lead to a physician’s claims getting rejected.

No control over billing

Some practitioners outsource their billing to a third-party service that manually processes their claims.

The downside of this is that physicians lose the ability to directly see what’s going on with their billings. Without 24/7 live reporting, a physician’s income becomes a black box. What’s the status on my recent claims? Is there an issue with my patient’s information? What claims are being rejected? What kind of premiums are available to me?

Most physicians would rather actively manage and track their main source of income, but they need an easy way to do so.

How can web and mobile billing tools help?

The physicians we speak with are usually considering using software to address these challenges – and with good reason. Medical billing software automates billing tasks that are repetitive and time-consuming for physicians.

It can also help reduce costly errors that are common when billing complex fee items. Health care practitioners shouldn’t have to memorize a 500-page document to get paid for the services they provide.

The key features & tasks that help healthcare professionals the most are:

- Submit billings to insurance providers (public or private) for payment

- Verify a patient’s insurance coverage

- Get prompts to help add claims correctly

- View reports on billings and rejections – instant insights, no Excel required

- Get alerts for claim issues

Individual physicians and small practices can transition from paper claims to a modern billing system to reduce paperwork, centralize record-keeping and improve efficiency.

Costs and return on investment

The prices of medical billing programs vary quite a bit.

Some charge upfront costs for licenses, setup and training. You may also need to pay ongoing maintenance and support fees, which are usually 15-20 percent of the upfront licensing costs.

Software-as-a-Service (SaaS) applications require lower upfront costs and ongoing monthly fees. These solutions are delivered over the web – no download required.

Getting a return on investment is easy with a modern billing solution. Practitioners will see improved billing efficiency and lower costs when submitting and following up on claims. By knowing which claims get rejected most often and which services are eligible for premiums, physicians can make data-driven decisions to increase revenue.

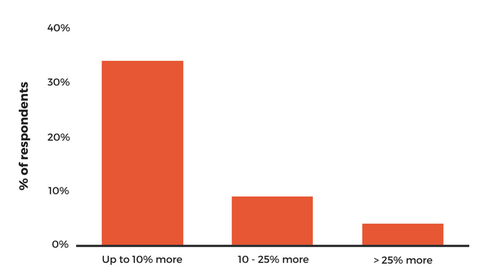

We surveyed our own users, and about half said they earned more by using our mobile billing solution. Some said they earned over 25% more!

When you include the hours of time saved each week, this all leads to positive outcomes for both doctors and patients.

Want to maximize your earnings? New to Ontario Billing?

Check out our Ultimate OHIP Billing Guide that takes you through every step for billing successfully in Ontario.

This article offers general information only and is not intended as legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. While information presented is believed to be factual and current, its accuracy is not guaranteed and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the author(s) as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by RBC Ventures Inc. or its affiliates.